Instrument depreciation calculator

The IRS also allows calculation of depreciation through table factors listed in Publication 946 linked below. The recovery period of property is the number of years over which you recover its cost or other basis.

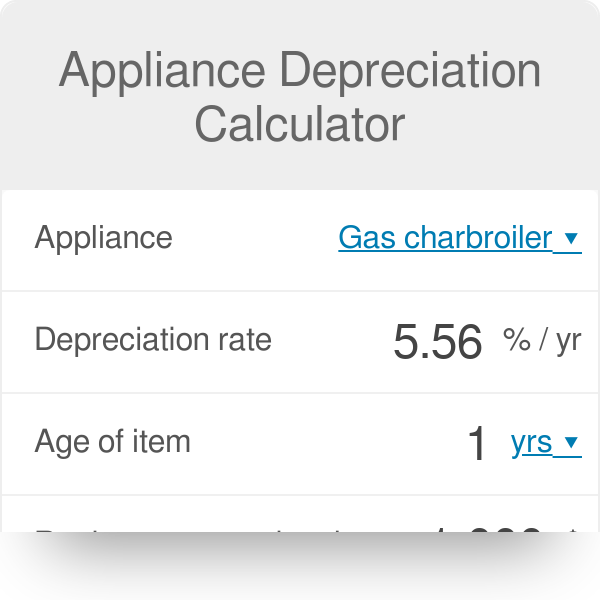

Appliance Depreciation Calculator

If you are placing your property in service during the year you must apply either the Half-Year.

. 1000 per year Keywords. Two types of depreciation on the Texas Instruments BA II Plus calculator - Straight Line and Double Declining. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

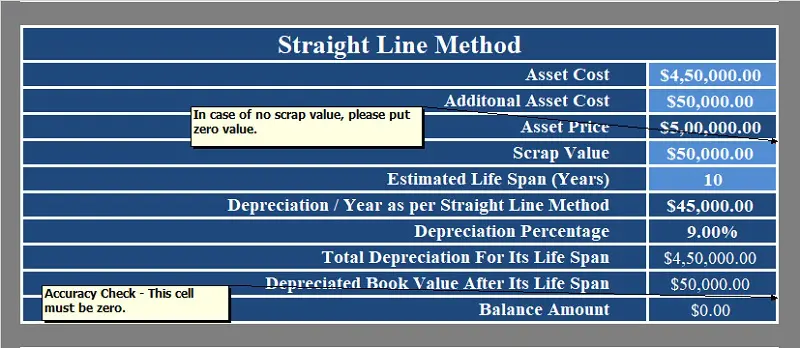

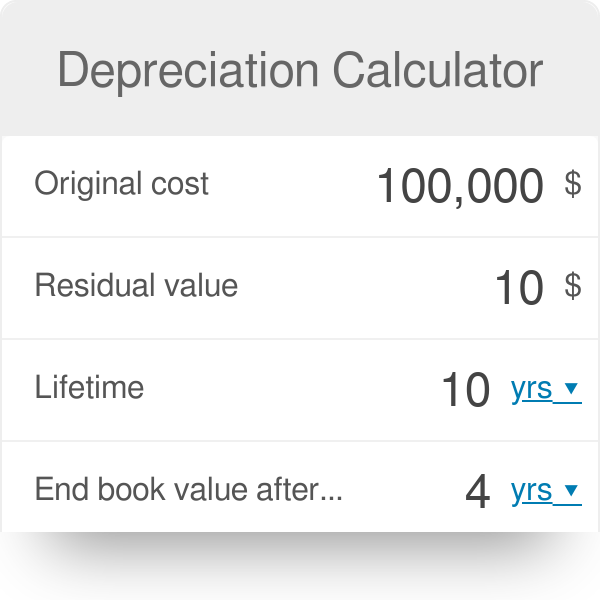

There are many variables which can affect an items life expectancy that should be taken into consideration. This depreciation calculator is for calculating the depreciation schedule of an asset. Straight Line Basis Purchase Price of Asset - Salvage Value Estimated Useful Life of the Asset For example say you.

Calculator Depreciation Item Age Years Replacement Cost 00 Office Equipment - Calculator Depreciation Rate. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices. The necessary amount expended to get.

After two years your cars value. Before H2020 the principle of calculating the depreciation of equipment considered the total hours of the equipments use in the project dividing them into the total. Office equipment calculator canon adding.

Musical Instruments. Also includes a specialized real estate property calculator. For example if you have an asset.

It is determined based on the depreciation system GDS or ADS used. Lets consider the cost of equipment is 100000 and if its life value is three years and if its salvage value is 40000 the depreciation value will be calculated as below. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

The calculator should be used as a general guide only. The formula for calculating appreciation is as follows. There are many variables which can affect an items life expectancy that.

Use 25 of replacement cost Keywords. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Percentage Declining Balance Depreciation Calculator.

For example lets assume that the purchase price of the. FV SV 1 AR T Where FV - Final value or is how much product cost you will get at the end of the term SV - Starting value or how. The MACRS Depreciation Calculator uses the following basic formula.

Our car depreciation calculator uses the following values source. It provides a couple different methods of depreciation. Depreciation Calculator Musical Instruments Supplies CD CD Depreciation Item Age Years Replacement Cost 00 Notes.

First one can choose the straight line method of. If you were to do the above math you would find the percent used to deduct depreciation in the first year is 1429. Depreciation on the TI II Plus calculator.

Here is the formula for straight-line depreciation. Inputs Asset Cost the original value of your asset or the depreciable cost. Use this calculator to calculate the simple straight line depreciation of assets.

You will most likely use the 200 declining balance rate but can elect to use another method. After a year your cars value decreases to 81 of the initial value. Depreciation is a method for spreading out deductions for a long-term business asset over several years.

The basic way to calculate depreciation is to take the. This calculator calculates depreciation by a formula. Disc cd compact disc.

The calculator allows you to use. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Pin On Papelaria

Hp 17bii Financial Calculator Financial Calculator Calculator Paying Off Mortgage Faster

Stock Dividend Calendar What It Tells And Why Its Important

Depreciation Calculator Depreciation Of An Asset Car Property

Calculated Industries Qualifier Plus Iix 3125 Scientific Etsy Vintage Electronics Calculator Scientific Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Macrs Depreciation Calculator With Formula Nerd Counter

Hp 12c Financial Calculator Financial Calculator Calculator Financial

Texas Instruments Ba Ii Plus Financial Calculator In 2022 Financial Calculator Calculator Calculator Design

Download Depreciation Calculator Excel Template Exceldatapro

Sharp El 738fb 3 X 5 9 16 10 Digit 2 Line Financial Calculator Calculator Time Value Of Money

Declining Balance Depreciation Calculator

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Definition Formula

Ti 30xa Scientific Calculator On Mercari Scientific Calculator Case Cover Booklet

Download Depreciation Calculator Excel Template Exceldatapro